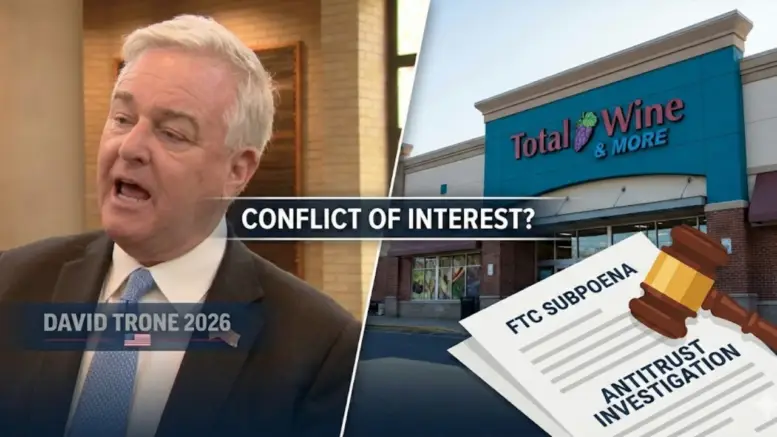

The nation’s largest alcohol retailer resisted FTC investigators for months, even as its co-founder served in the House. Now that David J. Trone seeks to return to Congress, Total Wine & More, Trone’s company, faces business pressures and questions about its federal lobbying.

By Ryan Miner | A Miner Detail

Former Maryland Congressman David J. Trone (D) is mounting a comeback campaign for Congress at a time when Total Wine & More, the alcohol retail chain he co-founded with his brother Robert Trone, is facing federal legal scrutiny, industry headwinds, and potential trade policy disruptions.

Court records and Federal Trade Commission filings reveal that Total Wine defied an FTC subpoena for more than four months in 2023, prompting the agency to file a lawsuit in federal court to compel compliance.

In 2023, Mr. Trone was serving as the U.S. Representative for Maryland’s 6th Congressional District.

The legal issues raise questions about the intersection of Trone’s political career and his business interests as he mounts a primary challenge against Rep. April McClain Delaney, the Democrat who succeeded him after he vacated the seat to run for U.S. Senate in 2024.

Total Wine & More’s Defiance of Federal Investigators

On October 20, 2023, the FTC filed a petition in the U.S. District Court for the Eastern District of Virginia seeking to force Total Wine to comply with a civil investigative demand.

Total Wine had resisted the administrative subpoena for months.

According to the FTC’s filing, the agency “tried to work cooperatively with Total Wine, but the company has failed to comply with the Commission’s CID for more than four months.”

The petition stated that Total Wine “categorically refused to search any employee-maintained files for documents and information needed to address the FTC’s CID and has failed to assert any valid reason for its refusal to comply.”

Henry Liu, Director of the FTC’s Bureau of Competition, said at the time:

“A civil investigative demand issued by the FTC is not a voluntary request; it is a demand made by the federal government that companies must comply with. Failing to comply with a CID ultimately hinders the FTC’s ability to protect consumers and businesses from anticompetitive practices.”

The subpoena was part of the FTC’s broader investigation into Southern Glazer’s Wine & Spirits, the nation’s largest alcohol distributor.

That investigation would eventually result in the FTC’s first Robinson-Patman Act enforcement action in more than two decades.

Total Wine Named as Beneficiary of Alleged Illegal Pricing

In December 2024, the FTC sued Southern Glazer’s, alleging the distributor violated the Robinson-Patman Act, a Depression-era antitrust law designed to prevent large buyers from gaining unfair advantages through discriminatory pricing.

The FTC’s complaint named Total Wine as one of the large retailers that allegedly received preferential treatment.

According to the same federal agency, Southern Glazer’s pricing practices gave its largest accounts, including Total Wine, Costco, and Kroger, “insurmountable advantages that far exceed any real cost efficiencies for the same bottles of wine and spirits.”

An FTC official told Wine Industry Advisor:

“In many instances, the price differences are eye-popping. It’s not a matter of pennies… We see this conduct across the board and in a consistent pattern. It’s not simply an isolated practice, but a central part of Southern’s business model.”

In April 2025, U.S. District Judge Fred W. Slaughter denied Southern Glazer’s motion to dismiss the case, ruling that the FTC had “sufficiently alleged” each element of a Robinson-Patman Act claim.

Litigation is ongoing.

Alcohol Industry Faces Declining Sales

The federal legal scrutiny comes as the broader alcohol industry confronts declining consumer demand and shifting consumption patterns.

According to NIQ data released January 21, 2026, total alcohol sales in the four weeks ending January 10 declined 3.4% year-over-year.

Spirits, Total Wine’s core category, fell 6.3%. Wine declined 5.4%. Beer showed the most resilience, down 2.1%.

The liquor channel, which includes Total Wine’s retail format, led value losses at 5.2%, according to NIQ.

Industry analyst Kaleigh Theriault, NIQ’s beverage alcohol thought leader, told Wine Business that 2025 was like “death by a thousand cuts (in reference to a Taylor Swift song),” citing personal spending cuts and the moderation trend.

The distribution tier is also showing signs of strain.

On January 16, 2026, Republic National Distributing Company, one of the nation’s largest alcohol distributors alongside Southern Glazer’s, announced it had secured new financing from its lenders “to support operations in an evolving industry.”

Trump Threatens 200% Tariffs on French Wine

Adding to industry uncertainty, President Donald J. Trump on January 19, 2026, threatened to impose tariffs of up to 200% on French wine and Champagne after French President Emmanuel Macron indicated France would decline to join Trump’s “Board of Peace” initiative.

“I’ll put a 200 percent tariff on his wines and Champagnes, and he’ll join,” Trump said. The United States is the largest export market for French wine and spirits, with shipments worth €3.8 billion in 2024.

Total Wine stocks extensive French wine and Champagne inventory across approximately 290 stores in the U.S. A 200% tariff, if implemented, would significantly affect pricing and product availability for retailers in this category.

Global Champagne shipments have already fallen to their lowest level in 20 years, excluding 2020, the height of the COVID-19 pandemic.

Shipments declined 2% to 266 million bottles in 2025, according to data from the Comité Champagne.

Total Wine Lobbying Congress on Regulatory Matters As Trone Seeks His Return

Total Wine continues to engage in federal lobbying even as it faces federal antitrust litigation.

On January 21, 2026, Total Wine became a founding member of the Beverage Alcohol Merchants Coalition, a new trade group supporting federal legislation to regulate hemp-derived THC beverages.

Other founding members include BevMo! by Gopuff, ABC Fine Wine & Spirits, and Spec’s Wine, Spirits & Finer Foods.

The Beverage Alcohol Merchants Coalition backs legislation introduced by Rep. James Baird (R-IN) in the House (H.R. 7024) and Sen. Amy Klobuchar (D-MN) in the Senate (S. 3686) to extend the federal hemp compliance deadline from 2026 to 2028.

The legislation would delay the federal ban on hemp-derived THC products until 2028, giving policymakers time to craft permanent regulations. The Coalition argues that this future framework should regulate these beverages through the existing three-tier alcohol distribution system.

Total Wine’s federal lobbying raises questions about potential conflicts of interest if David Trone returns to Congress while maintaining his ownership stake in the company.

The hemp-derived THC market is at an inflection point.

Congress in November 2025 enacted legislation narrowing the federal definition of “hemp,” effectively closing the 2018 Farm Bill loophole that allowed intoxicating hemp products to proliferate nationwide.

The new definition takes effect on November 12, 2026.

Total Wine & More’s Response to A Miner Detail

In an email to A Miner Detail on Sunday, January 18, 2026, Total Wine General Counsel Robert Shaffer disputed the characterization of the company’s compliance with the FTC investigation.

“Regarding your specific questions about the FTC’s investigation of Southern Glazer in October 2023, that investigation ended some time ago and is now the subject of litigation against Southern only,” Shaffer wrote.

“During the earlier investigation of that matter, our company produced voluminous amounts of records in aid of the FTC’s investigation of Southern. Our company is not a party to the pending litigation against Southern.”

Shaffer’s statement that Total Wine “produced voluminous amounts of records” differs from the FTC’s October 2023 court filing, which stated the company “categorically refused to search any employee-maintained files” and “failed to comply” for “more than four months.”

Shaffer confirmed David Trone’s continued ownership stake:

“Mr. Trone is a co-owner of Total Wine’s business and one of several members of the Board of Directors. The day-to-day operation of our business is handled by an executive leadership team, which does not include our owners.”

A Miner Detail sent Shaffer a follow-up email with additional questions on January 18, 2026. Total Wine did not respond to A Miner Detail’s further questions.

Political Context

David Trone represented Maryland’s 6th Congressional District from January 2019 until January 2025, when he departed to pursue a U.S. Senate seat.

He lost Maryland’s U.S. Senate Democratic primary to Angela Alsobrooks on May 14, 2024, who went on to win the November general election against former Maryland Governor Larry Hogan (R) and become Maryland’s first Black U.S. Senator.

Mr. Trone’s 2024 U.S Senate bid was among the most expensive in American history; he spent roughly $62.9 million of his own money on the race, according to Federal Election Commission records.

In December 2025, Trone announced he would challenge McClain Delaney in the 2026 Democratic primary for the seat he had vacated. The announcement came months after Trone had publicly endorsed McClain Delaney’s campaign for the seat.

McClain Delaney has secured endorsements from much of the Maryland Democratic Establishment, including Maryland Governor Wes Moore.

David Trone and his campaign did not respond to two requests for comment for this article.

Editor’s note: David J. Trone co-founded Total Wine & More with his brother Robert in 1991. He stepped down as president of the company in December 2016 before his congressional tenure began, but remains a co-owner. Federal financial disclosure records filed during his time in Congress listed his Total Wine holdings as his primary source of wealth.