The Maryland Democratic Party recently launched a poorly designed and user-unfriendly website, BudgetFactsMD.com.

Heads up: For a state Party with loads of money from wealthy donors, their website’s aesthetics desperately need Botox, filler, and perhaps a nip and a tuck.

This basic website touts Maryland Gov. Wes Moore’s (D) latest budget as fiscally responsible (LOL) while blaming former Republican Governor Larry Hogan for the state’s current financial challenges.

A closer examination reveals that the state Democratic Party’s funny website makes several misleading claims, omits context, and cherry-picks data to bolster Mr. Moore’s tax-and-spend agenda rather than provide a complete picture of Maryland’s budget reality.

It’s readily apparent that the Maryland Democratic Party does not employ maybe one or even two Wharton or University of Maryland MBAs, nor have they hired any BCG or McKinsey budgetary wonks to explain the art of budgeting.

Here’s the problem: When progressive social activists jump into partisan politics, their lack of life experience and understanding of basic budgeting and complex fiscal concepts becomes evident. They often hold a theoretical view of life until their own wallets are affected.

Let’s call it what it is: The Maryland Democratic Party is lying.

But take heart. This article comprehensively fact-checks the Maryland Democratic Party’s torrent of false statements.

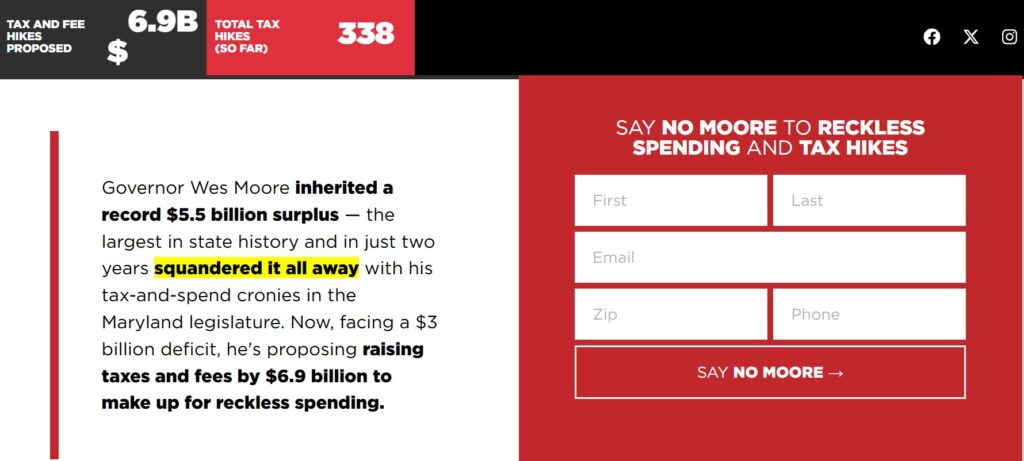

Incidentally, A Miner Detail emphatically encourages fellow Marylanders to follow and subscribe to NoMoore.org, a newly launched Maryland grassroots network designed to educate taxpayers about Wes Moore’s fiscal follies.

False Claim: Larry Hogan’s Budget Surplus Was an Illusion Created by COVID-19 Funds

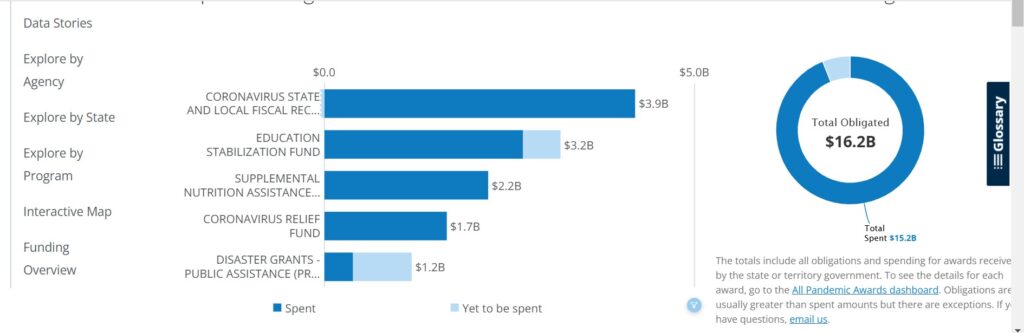

According to the Maryland Department of Budget and Management, Maryland was allocated $3.72 billion by the Federal Government for the American Rescue Plan, Coronavirus State and Local Fiscal Recovery Funds (SLFRF), signed into law on March 11, 2021, by then-President Joseph R. Biden Jr.

These funds helped state, territorial, local, and tribal governments respond to the economic and public health impacts of COVID-19.

Additionally, the Pandemic Response Accountability Committee data indicates that Maryland received $3.9 billion in State and Local Fiscal Recovery Funds and $3.2 billion in Education Stabilization Funds.

Fact Check: Partially true – but misleading

The Maryland Democratic Party asserts that one-time federal COVID-19 relief funds fueled former Governor Hogan’s reported budget surplus and that his administration failed to implement long-term solutions for the state’s structural deficit.

It is accurate that Maryland received substantial federal aid during the pandemic, which temporarily boosted state revenues.

However, Maryland’s budget surpluses under Hogan were not solely a result of federal funds.

The Hogan administration routinely outperformed revenue projections, and multiple credit rating agencies praised Maryland’s fiscal management during his tenure.

In February 2020, all three major rating agencies — S&P Global Ratings, Moody’s Investors Service, and Fitch Ratings — reaffirmed Maryland’s AAA bond rating, highlighting the state’s proactive fiscal management and stable economic outlook.

Moreover, Maryland’s revenue performance often exceeded projections.

In September 2022, Gov. Hogan expanded a scheduled pay increase for state employees, a decision made possible by higher-than-expected revenue forecasts.

The Maryland Democratic Party’s claim also conveniently ignores that the Maryland General Assembly—controlled by progressive Democrats—had the power to propose long-term, fiscally responsible solutions but chose not to.

In December 2022, with roughly a month left in his second term, Mr. Hogan “warned incoming leaders to keep a tight lid on spending. Failure to do so, he told reporters at a State House news conference, would jeopardize what he called the “best fiscal position that the state has ever been in.”

Furthermore, while Mr. Hogan’s administration reduced cash reserves from $5.5 billion to $2.3 billion, much of that spending went toward infrastructure and tax relief — decisions made with bipartisan support in the legislature.

Mr. Hogan’s fiscal policies were developed in collaboration with the Democratic-controlled General Assembly, reflecting bipartisan support for allocating funds toward infrastructure enhancements and tax relief efforts.

The Maryland Democratic Party’s false assertion that Larry Hogan “spent down” reserves irresponsibly lacks context and ignores legislative complicity.

Hogan Administration Facts

The Maryland Democratic Party has criticized former Governor Larry Hogan for irresponsibly depleting the state’s reserves.

This claim is nonsense.

The state Democratic Party duplicitously omits critical context regarding the bipartisan nature of fiscal decisions during Mr. Hogan’s gubernatorial tenure.

Bipartisan Fiscal Decisions:

-

Tax Relief Initiatives: In March 2022, Gov. Hogan and legislative leaders reached a bipartisan agreement to provide $1.86 billion in tax relief over five years, targeting retirees, small businesses, and low-income families.

-

Infrastructure Investments: That same month, a bipartisan commitment allocated an additional $663 million in grants over four fiscal years to local governments for infrastructure and transportation projects.

These initiatives, supported by both Democratic and Republican state lawmakers, contributed to the reduction in the state’s cash reserves.

Consequently, portraying state spending solely as the result of Mr. Hogan’s unilateral actions vastly overlooks the collaborative legislative process that guided Maryland’s financial decisions.

False Claim: Wes Moore’s Budget is Fiscally Responsible and Reduces Spending

The Maryland Democratic Party frames Gov. Moore’s latest budget as a responsible spending plan that maintains a robust Rainy Day Fund, cuts taxes for most Marylanders, and eliminates the structural deficit while making critical investments.

Fact Check: Misleading.

While Moore has maintained over $2 billion in the Rainy Day Fund, his administration also proposed over $1 billion in new taxes and fees to offset spending.

The bogus claim that Mr. Moore’s budget “reduces spending” is contradicted by the fact that it relies on higher revenue collection rather than actual government downsizing.

Mr. Moore’s budget doesn’t cut government spending.

Instead, his budget relies on bringing in more money from us, the taxpayers, through higher taxes and fees. That’s not a spending cut; that’s a revenue increase.

Imagine your household budget.

Let’s say you’re spending too much every month — your bills are piling up, and you’re running a deficit.

A spending cut would mean trimming expenses—maybe eliminating the umpteen streaming services we all love, forgoing one less cup of daily Dunkin, or, God forbid, cutting back on our political donations.

Now, imagine telling your boss (if you have a boss) that you want a raise to cover your spending instead of cutting expenses. If your boss agrees and you get that extra income – great!

But you haven’t actually cut your spending — you just brought in more money to maintain the same or even higher spending levels.

Wes Moore’s Bloated Maryland Budget

Gov. Moore’s latest budget keeps spending high but demands more revenue (taxes and fees) to cover it. The government isn’t getting smaller; it’s just making you pay more to keep spending at the same or higher levels.

So when the Mayland Democratic Party claims that Mr. Moore’s administration is “reducing spending,” they really mean, “Wes Moore isn’t cutting anything.” He and like-minded progressive Maryland Democrats are forcing Maryland taxpayers to pay for their progressive spending plans.

The Institute on Taxation and Economic Policy (ITEP) reports that approximately 65% of Maryland households would see a tax reduction, primarily benefiting middle and low-income families, meaning:

- About 20% of Maryland households, predominantly those earning more than $169,700 annually, would experience tax increases;

- Notably, more than three-fourths of the new revenue would come from the wealthiest 20% of households, with 80% of the revenue from rate, bracket, and capital gains changes from the top 1% of earners;

- This approach effectively redistributes the tax burden, relieving lower-income residents while increasing taxes on higher earners.

The Associated Press further highlights that Mr. Moore’s 2025 tax-increase proposal introduces higher tax rates for individuals earning over $500,000 and $1 million.

The Maryland Democratic Party’s UX/UI Journey to Nowhere website demonstrates examples of Wes Moore’s tax cuts for specific Maryland demographics (teachers, young professionals, and families).

Nevertheless, the state Democratic Party’s website version of Microsoft FrontPage circa 1999 fails to mention that Mr. Moore’s broader tax package includes business tax hikes and an expansion of taxation on services — costs that will ultimately affect consumers.

False Claim: Wes Moore’s New State Taxes Only Affect Maryland’s Wealthiest Residents

The Maryland Democratic Party insists that Mr. Moore’s tax plan targets only the top 1% of Maryland earners while protecting middle-class families.

Fact Check: Garbage

Wes Moore’s latest bloated tax package includes corporate tax changes, a proposed retail delivery fee, and business tax restructuring — all of which will have downstream effects on working-class Marylanders.

For instance, Mr. Moore’s retail delivery fee will undoubtedly increase consumer costs, as businesses will likely pass on the additional expense. Similarly, changes in corporate taxation could influence pricing strategies, potentially impacting the affordability of goods and services.

Demonstrating peak elitism, Mr. Moore and the Maryland Democratic Party are pushing the narrative that these taxes will not directly impact middle-class families.

That notion insults anyone with a middle-school understanding of basic economics. We recommend reading Henry Hazlitt’s timeless classic, “Economics in One Lesson.”

History shows that price increases and economic shifts disproportionately harm lower-income residents.

Numerous studies have demonstrated that price increases and economic shifts disproportionately impact lower-income individuals.

- For instance, research from the Federal Reserve Bank of Dallas indicates that high inflation rates disproportionately affect low-income households, including Black and Hispanic families, as well as renters.

- Similarly, the Federal Reserve Bank of Minneapolis reports that low-income households experience approximately 10% higher inflation over time compared to their higher-income counterparts.

- Additionally, the U.S. Bureau of Labor Statistics found that from 2005 to 2020, the lowest-income households faced an average annual inflation rate of 0.29 percentage points higher than the highest-income households.

These findings underscore the heightened vulnerability of lower-income populations to economic fluctuations and rising prices.

Marylander taxpayers and longtime residents have fled Maryland after Democratic tax hikes

Migration patterns seen after former Maryland Governor Martin O’Malley’s “millionaire’s tax” contradict the idea that Maryland’s wealthiest residents are thrilled to pay more taxes and won’t leave due to tax hikes.

Studies have indicated that Maryland experienced a notable outmigration of affluent taxpayers following the implementation of former Maryland Governor Martin O’Malley’s “millionaire’s tax.”

Several studies have examined the impact of Maryland’s “millionaire’s tax” on the migration patterns of high-income residents:

- Maryland Public Policy Institute (2014): This analysis of IRS data revealed that from 2007 to 2012, over 18,600 tax filers left Maryland, resulting in a loss of approximately $4.2 billion in adjusted gross income. The study suggests that the tax policies during this period may have influenced the relocation decisions of affluent residents.

- American Legislative Exchange Council (2012): This site reported on a Change Maryland (Larry Hogan’s grassroots movement) study that found that a net 31,000 residents exited the state following the implementation of Maryland’s “millionaire’s tax” in 2007, leading to an estimated $1.7 billion loss in tax revenues. The study indicates that higher-income residents were among those leaving, implying a potential link between tax increases and outmigration.

-

Tax Foundation Analysis (2009): Former Maryland Comptroller Peter Franchot’s office reported a 30% drop in the number of “millionaire” tax returns between 2007 and 2008, along with a 22% decrease in declared income.

While the Democratic Party argues that the decline in Maryland millionaires was due to the 2008 financial crisis, multiple reports found that Maryland was one of several high-tax states experiencing a net loss of wealthy residents.

The tax flight debate is far from “debunked,” as the Maryland Democratic Party’s fun-to-point-and-laugh-at website claims.

Bogus Claim: The 338 Tax Hikes Figure is False

The Maryland Democratic Party argues that claims of 338 new taxes under Mr. Moore are exaggerated, citing a Baltimore Sun analysis that found only 10% of the fees were newly created and that many were pre-existing.

Fact Check: Misleading

Mr. Moore’s actions contradict his claim of fiscal restraint. He has overseen multiple revenue-raising measures, even if the exact number of new taxes and fees is debated.

The argument that businesses, not consumers, will absorb costs from the new retail delivery fee is unrealistic — most businesses will pass these costs on to customers.

Furthermore, fees for professional licenses, vehicle registrations, and state services have increased, affecting a broad swath of Marylanders.

Maryland’s Budget Debate: Cutting Through Political Spin

The Maryland Democratic Party’s factless budget website unequivocally presents a one-sided narrative that omits inconvenient facts and exaggerates Mr. Moore’s budget plan’s untested “successes.”

While it is true that Maryland faced structural deficits before Mr. Moore took office in January 2023, blaming Larry Hogan alone fundamentally ignores the role of Maryland’s General Assembly in shaping the state budget.

Mr. Moore’s push for higher taxes and fees directly contradicts his claim of fiscal restraint. His redistribution of the tax burden does not constitute a broad-based tax cut.

The only reason the Maryland Democratic Party felt compelled to launch this website is that they know Wes Moore’s approval ratings are plummeting.

The state Democratic Party is transparently desperate to control the narrative before voters catch on.

With Mr. Hogan eligible to run again for Maryland governor in 2026, state Democrats are already bracing for a potential political comeback that could upend Wes Moore’s administration (and future presidential run) and expose his blatant fiscal mismanagement.

As Maryland navigates future budget debates, Maryland voters should be wary of political messaging that simplifies complex fiscal issues into partisan talking points.